By: Chris Perkins & Laban Johnson of Abundance Asset Management

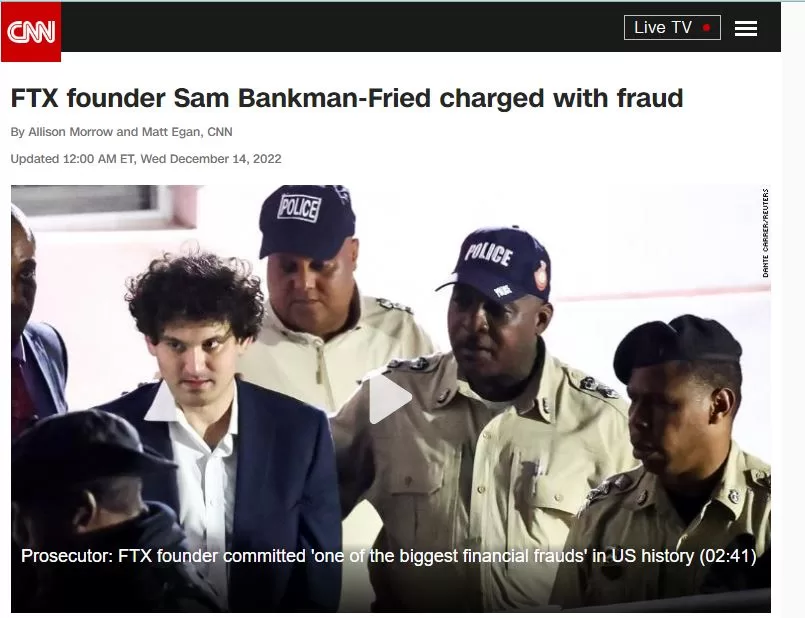

In the wake of the collapse of the third largest cryptocurrency exchange, FTX, and the arrest and indictment of SBF and partners, crypto investors are left scrambling, puzzled and angry.

The failure of FTX has had far-reaching consequences. Investors have been left with hard lessons and difficult questions regarding their investments. Protests have taken place in the streets while civil lawsuits and criminal charges have been filed and arrests have been made.

On the grand scale, the loss of investor trust and confidence, reduced liquidity, increased volatility, and a market vulnerable to manipulation have created a “crypto winter”. These effects will be felt for some time.

In this article, we will discuss the causes and effects of the FTX failure and hear insights and analysis from Chris Perkins, expert trader and investor, creator of The Abundance Strategy, and President and CEO of Abundance Asset Management. Chris offers advice for fellow investors on how to avoid a costly repeat and invest confidently. He also shares what protections fund managers like himself are putting in place to restore and maintain investor confidence.

By understanding the FTX failure and learning from the wisdom of experienced traders and investors like Chris, investors can be better equipped to make smart decisions for their future.

This article is for anyone interested in investing, but especially for those individuals who may be feeling unsure about the risks and rewards associated with investing. We want to provide people with the knowledge and confidence to make smart, informed decisions that will help them achieve their financial goals. We want to help people understand the importance of regulations and best practices in investing, and how Abundance Asset Management can help them achieve their goals.

Help spread the word about the risks of investing with unregulated exchanges and the importance of investing with a trusted financial advisor. Share your thoughts on this topic with your friends and family, and help keep everyone safe from financial disaster!”

The underlying causes of FTX’s failure can be summarized as this:

FTX was an unregulated exchange with way too much debt, poor accounting practices and misappropriations of investor funds for political donations, among other frivolous endeavors.

Too much debt

The company was over leveraged when it took out loans and gained funding from outside sources to create billions of dollars in net worth on paper.

Poor accounting practices

FTX failed to properly document its financial transactions and investments, opting not to use third party accounting or administration, resulting in a lack of transparency and accuracy in its financial reporting.

The company used complex schemes to avoid paying taxes, which could be considered tax evasion by the IRS.

Further, FTX failed to disclose its financial obligations and liabilities, which left investors in the dark about the company’s true financial state.

Political donations

The company used investor money for political donations, which, according to some sources, is believed to have been used to influence the outcome of elections. Then, FTX failed to properly disclose its related-party transactions, which led to conflicts of interest.

Let’s take a deeper dive.

Causes of the FTX Crash: In Depth

FTX created their own cryptocurrency, FTT, by launching an Initial Exchange Offering (IEO) in April 2019. Through this offering, FTX was able to raise the funds necessary to launch FTT, as well as other tokens on its platform. This was done by allowing users to buy FTT tokens with other cryptocurrencies such as Bitcoin and Ethereum. Additionally, FTX also used its own funds to create the FTT tokens.

FTX sold FTT tokens to itself under the business name Alameda Research, which is a crypto trading firm that is owned and operated by the same individuals who own and operate FTX. Alameda Research was able to purchase FTT tokens directly from FTX, allowing the company to get the capital needed to launch FTT on its platform. This process was done in order to ensure that the FTT tokens had enough liquidity and demand to be successful on the open market.

FTX was able to create billions of dollars in net worth on paper by taking out loans and gaining funding from outside sources. However, when people attempted to withdraw more money than what actually existed on the platform, this resulted in the collapse of the company.

FTX investor money was used for political campaign donations by Alameda Research, so it was able to transfer a portion of the funds raised through the Initial Exchange Offering (IEO) for FTT tokens to political campaigns. This money was used to support certain candidates, and is believed to have been used to influence the outcome of elections.

FTX acted like a bank, but it was not a bank. FTX acted like a bank by offering a variety of services such as crypto-backed loans, margin trading, and derivatives trading. It also provided a platform where users could deposit, store, and trade digital assets and conduct transactions with other users. Additionally, the platform featured a variety of features such as market data and analytics, order books, and a user-friendly interface. All of these features allowed FTX to provide users with an experience similar to that of a traditional banking institution.

Even though FTX acted like a bank, FTX was not a bank. It is possible that FTX was not subject to banking regulations, and this may have been a contributing factor.

Without the oversight and regulations of a bank, FTX may have had more freedom to take on more debt and engage in false accounting, unchecked. They clearly lacked the transparency and accountability that would be expected of a bank, which could have made it easier for them to commit fraud on their depositors and investors.

These combined factors led to the collapse of the company and the loss of investor funds.

A little legal disclaimer: It is unclear at the time of this writing whether everything what FTX did was completely legal or not – that is ultimately up to the courts to decide. Without further information that is still coming out and will probably continue to be discovered through the civil and criminal cases over the course of the next few months and years it is impossible to determine which of their actions were legal or not. We will leave that to the legal processes to determine. The purpose of this article is to analyze and learn from what happened so investors and traders can take lessons from this experience and invest confidently, going forward.

What is clear is that FTX failed to fulfill its mission of providing a sustainably secure, reliable and efficient platform for traders to manage their digital assets. The company was unable to keep its users safe and secure, as FTX was supposedly designed to protect against the risks associated with cryptocurrency trading.

Summary of Effects of the FTX Crash

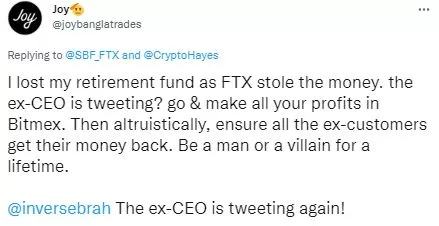

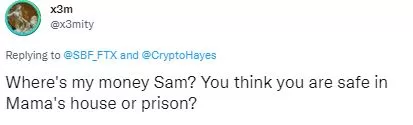

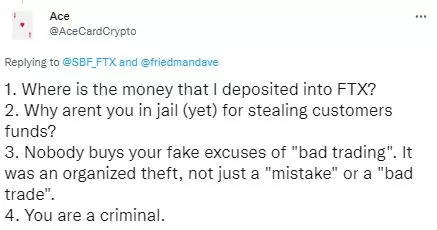

The FTX crash has had far-reaching effects beyond the immediate criminal charges and arrests of Bankman-Fried. Investors have been left with a sour taste in their mouth as they learn some hard lessons, as well as asking even harder questions as to how such a fraudulent scheme could occur. Additionally, protests have been seen in the streets as people express their outrage. Civil lawsuits and criminal charges are being filed against Bankman-Fried and other parties involved. On the bigger scale, the incident has had a chilling effect on the cryptocurrency markets, leading to a loss of investor trust, reduced liquidity, increased volatility, and a market that is now more vulnerable to manipulation. This has exacerbated the current “Crypto Winter” that the markets are experiencing.

“The sad fact is, there will always be someone out there willing to take too much risk with other people’s money to either pursue their own agenda or attempt to gather attention with unsustainable returns,” says Chris Perkins of Abundance Asset Management. “I’m not sure you can prevent something like this. However, you can learn from it.”

This statement reflects a sobering reality of the financial markets: that there will always be individuals or entities willing to take excessive risks with other people’s money in pursuit of their own objectives or a short-term gain. This can have devastating consequences, as we have seen from the FTX scandal where investors suffered large financial losses when the risks taken do not pay off. Investors need to be aware of this risk and to exercise caution when making any financial decisions.

Best Practices:

Ideally, FTX should have operated with best practices in mind and being transparent and open about their operations and in their accounting and financial statements so investors could make well-informed decisions about their involvement with the company.

“Best practices” refer to a set of standards, procedures, and guidelines that organizations should integrate into their operations in order to ensure efficiency and compliance.

These standards are generally referred to as good governance, corporate governance, or financial management best practices.

There are many different names for these standards, such as Generally Accepted Accounting Principles (GAAP), the Sarbanes-Oxley Act, the Basel Accords, the International Financial Reporting Standards, Principles of Corporate Governance, and more. – all of which FTX should have been aware of and applied in their operations. Perhaps, by following best practices already in existence and widely accepted, the company would likely still be in operation today.

Ivestors who have been adversely impacted by the FTX crash need to know that generally accepted standards exist and are being applied by many great investment companies because these standards provide a way to ensure that companies are taking appropriate steps to protect the interests of their investors to provide an additional layer of protection against fraud and other types of financial loss. Investors can feel more confident in their investments and more secure in the knowledge that their investments are being protected.

Restoring Investor Confidence

What are the lessons investors should be taking from the FTX failure? And, most importantly, how can you invest with confidence in the wake of the FTX failure?

When you are working with companies that adhere to standards, best practices, and comply with regulations, combined with safeguards like deposit insurance and fraud protection, investing is a safe and secure process.

Due Diligence

“Due Diligence is key here, not just on the strategy of the investment but also on the operators,” Chris Perkins adds.

“Due diligence” is the process of researching and analyzing a potential investment before committing money to it. This involves a thorough review of a company’s financials, management team, industry trends, and other relevant information that can help investors make an informed decision. It is an crucial step in the investment process and helps ensure that the investor is not taking on excessive risk.

Investor Education

Educate yourself on the investment and the operators by taking online courses, joining investment clubs, reading books, and engaging in financial blogs.

Educate yourself: Investing can be a complicated and risky endeavor, so it’s important to be well-informed before taking any action. Do your research thoroughly, read up on the fundamentals of investing, and consult with a financial advisor if necessary. Ensure that the venture is legitimate, financially sound, and has a good track record.

When investors avail themselves of the numerous resources available to help them make informed decisions, such as financial advisors, research websites, and financial publications investing can be a rewarding and profitable experience.

Online courses: There are many free and paid online courses available to help investors become more educated about investing. Coursera, Udemy, and Khan Academy offer a variety of courses on investing and finance.

Investment clubs: Joining an investment club can be a great way to learn from more experienced investors. Most clubs meet on a regular basis to discuss investments and share ideas.

There are many books available for investors to learn about investing and the fundamentals of the stock market. Some popular titles include “The Intelligent Investor” by Benjamin Graham , “The Little Book of Common Sense Investing” by John Bogle and a few “Stock Options for Income” books, for starters.

Financial blogs: Many financial blogs can help investors stay up to date on the latest market news and trends. Some popular sites include Investopedia, The Motley Fool, and MarketWatch.

Local financial advisors: Working with a financial advisor can help investors gain a better understanding of the markets and develop an investing strategy tailored to their individual needs. The Financial Industry Regulatory Authority (FINRA) provides an online directory of financial advisors at https://brokercheck.finra.org/. The directory can be sorted by location or specialty.

Risk Assessment

Understand the risks associated with the investment and don’t be too aggressive.

Understand the Risks: Every investment carries a certain degree of risk. Be sure to understand the risks associated with the venture before investing.

Don’t be too aggressive: Investing in high-risk investments can be tempting, but it can also be risky. Investing is a long-term strategy, so be aware of your risk tolerance and diversify investments to spread risk. Remember that it takes time and patience, and taking on too much risk can lead to losses that are difficult to recover from. Consider your financial situation, risk tolerance and goals before taking on too much risk.

Management Risk: The investor should consider not only the track record of the asset(s) they seek to place capital in but also the management team of the company they are investing in.

“Does it sound too good to be true? If yes…You know what to do,” Chris warns.

This means that if something sounds too good to be true, it probably is, and it may be best to proceed with caution or to not proceed at all.As the investor, the choice is always yours.

Diversification

Diversify your investments and set realistic expectations.

Diversify your investments (but don’t OVER diversify): We’ve all heard the saying “Don’t put all of your eggs into one basket.”

Investing in some mix of asset classes such as stocks, bonds, mutual funds, ETFs is typically advised, depending on the individual’s investing needs and goals.

Investment advisors will assess your risk tolerance by asking you questions about your financial goals, time horizon, and risk preferences. This helps them determine what type of asset classes, allocations, and investments are best suited for your individual situation.

However, before you take a deep dive down the rabbit hole of the many investment classes, Chris warns against over-diversifying your portfolio and spreading your investment dollars too thinly:

“A certain amount of diversification is important. However, over diversification will damage returns in the long run because there will inevitably be more underperforming assets the more diversified you are.”

Chris believes some investment vehicles are worth spending more time researching than others.

“I wouldn’t want to waste peoples time researching ¾ of these vehicles,” he warns.

He continues:

“9 out of 10 mutual funds underperform the S&P 500,” he points out.

Source: S&P Dow Jones Indices. “SPIVA U.S. Mid-Year 2022” As of June 30, 2022. https://www.spglobal.com/spdji/en/research-insights/spiva/#us

Past performance does not guarantee future results.

“Bonds tend to not keep up with inflation leaving the bond holder with a negative net return,” Chris says.

Source: 10 Year Treasury Rate – 54 Year Historical Chart

Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of January 05, 2023 is 3.71%. https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

Past performance does not guarantee future results.

“Stocks are very difficult to pick unless you have a lot of time and knowledge to thoroughly research the companies you want to invest in, “ he adds.

Investing in stocks requires careful analysis of company fundamentals, industry trends, and other factors that can influence the stock price. Without the proper research and analysis, it can be difficult to pick the right stocks and make a profitable investment.

“If you have deep knowledge about a few assets, you’ll invest more confidently. This will enable you to dollar cost average with confidence when there is a downturn in the markets rather than selling for a loss out of fear, uncertainty and doubt,” he says.

Chris refers to dollar cost averaging, an investment strategy that involves investing a fixed amount of money in a security at regular intervals, regardless of the share price. The benefit of this strategy is that it allows for averaging out the purchase price of the security over time, reducing the risk of investing all at once and potentially buying at a high price. This method of investing can help to ensure that any declines in the security value are offset by the lower cost of the remaining shares purchased.

Chris also emphasizes the importance of avoiding emotional investing driven by fear and doubt, as it can lead to poor, even irrational decision-making and financial losses, putting your investments at risk. He encourages instead to invest with a clear and rational, disciplined thought process, having a sound, realistic investing plan and sticking to it objectively, keeping an eye on your long-term goals and understanding that market fluctuations are a normal part of the investment process.

One type of investment that can help you do this is exchange-traded funds (ETFs), as Chris points out, below.

Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges, just like stocks. They are composed of a basket of assets such as stocks, bonds, commodities, or a combination of these, and are typically designed to track an index such as the S&P 500.

“Exchange-traded funds (ETF’s) that track index funds tend to be a great way to attain diversification and not have to agonize over finding the perfect companies,” Chris emphasizes.

The underlying assets of an ETF are preselected and managed by professionals. Therefore, investing in ETFs can be likened to copying off of a smart kid’s homework in the sense that it is an easy way to gain exposure to the markets and diversify your portfolio without having to do a lot of hard work of research and due diligence of picking individual stocks or investing in other assets. It allows you to mimic the performance of a portfolio that has been carefully researched and designed by experts, just like copying off of a smart kid’s homework.

Moreover, ETFs can be traded throughout the day just like stocks, while mutual funds can only be traded at the end of the trading day. ETFs also tend to have lower fees than mutual funds, which can add up over time and provide investors with more money to reinvest. Lastly, ETFs are generally more tax efficient than mutual funds since the underlying holdings are not actively traded and thus do not trigger capital gains taxes as often.

PRO TIP: ETFs provide an easy way to invest and diversify without having to do much research. They can be traded like stocks, have lower fees than mutual funds, and are more tax efficient.

Investing in ETFs can be a great way to diversify a portfolio while still taking into account other factors such as investment style, asset allocation, risk tolerance, investment costs, and tax implications. ETFs can provide an easy way to invest and diversify without having to do much research, and they typically have lower fees than mutual funds and are more tax efficient. When considering ETFs for diversification, it is important to consider these factors in order to make sure your investments are aligned with your goals and risk profile.

Consulting an investment advisor can be beneficial when working through these steps because they can provide insight and guidance on how to properly diversify a portfolio and minimize costs while maximizing returns.

Abundance investors can get expert investment advice from our registered investment advisor, and advanced tax advice from our CPA partner, as an value added benefit.

Another important investing lesson that can help you invest more confidently is to set realistic expectations: Don’t expect to get rich overnight. Investing is a long-term strategy, and it can take time for the investments to appreciate in value or produce significant cash flow.

Understand the risks associated with the investments you are considering.

Understand your own risk tolerance level and don’t invest in something you are not comfortable with.

Consider your financial situation and long-term goals.

Understand the expected returns of the investments you are considering.

Consider the amount of time you are willing to commit to researching and monitoring your investments.

Have realistic expectations about the potential for loss (realized losses or unrealized losses) and make sure you are prepared for it, mentally and materially.

Questions You Should Ask a Fund Manager

When working through your due diligence process, it is important to ask yourself and the fund manager questions to quickly highlight potential red flags.

“Here are a few initial questions to ask yourself and the fund manager when working through your due diligence process that can help to quickly highlight potential red flags,” Chris Perkins offers:

“Do they have in house accounting or a third party? A third party doing the administration work for the fund brings an additional layer of transparency and accountability.”

It is important to understand who is responsible for the fund’s accounting, and to make sure they have the necessary experience and qualifications.

“Is it speculative and/or heavily leveraged?”

Speculative and heavily leveraged investments involve a high degree of risk and can result in significant losses. These investments are typically characterized by a high degree of volatility, which can amplify losses in a short period of time. In addition, these investments often involve complex financial instruments, such as derivatives and options, which can be difficult to understand and can increase the risk of loss for a do-it-yourselfer. It is important to have a thorough understanding of the risks associated with these investments before investing.

“Is the operator trustworthy?”

When considering any investment, it is valuable to consider the trustworthiness of the operator. This includes researching their background and whether they have a good reputation in the industry. It is also worthwhile to determine whether the operator adheres to industry regulations like those mentioned above, and whether they have a good strategy and track record of providing returns to their investors. Look into the fees and commissions associated with the investment, as well as any potential conflicts of interest that may exist. You’ll also want to Investigate the level of customer service and support they provide by checking their reputation online.

“Does the operation team have a philanthropic mission or are they just here to make money?”

“Having a philanthropic mission is not only good for society, it also shows a deeper “why” than getting wealthy.”

The philanthropic mission of an investment company would be to use its financial resources to support projects and organizations that create positive social change and improve the quality of life in the communities it serves. This could include investing in projects that promote education, health, and economic development, as well as providing grants, loans, or other forms of financial support to organizations with a similar mission.

There are several reasons why having a philanthropic mission makes for a great investment.

First, companies that have a philanthropic mission often prioritize their commitment to the community, sustainability, and ethical investing. This can provide an investor with confidence that their money is being invested responsibly and that their investments are supporting positive initiatives.

Second a company’s philanthropic mission can help investors to align their portfolios with their own values, giving investors the satisfaction of knowing that your investments are supporting positive initiatives that are important to you and contributing to a better world.

This helps to create a sense of purpose and connection with your portfolio. The result is that investing in companies with a philanthropic mission can lead to increased returns, as research has shown that companies with strong social and environmental commitments tend to outperform the market, due to the increased interest in sustainable and ethical investments. These companies are more attractive to investors looking for long-term returns.

Finally, a company’s philanthropic mission can create a positive brand image, which can lead to increased customer loyalty, increased visibility, and the potential for higher profits. This can have a positive effect on stock prices, leading to increased returns for investors.

Overall, investing in companies with a philanthropic mission is a great way to support positive initiatives and to achieve potentially greater returns.

Monitor your investments and have an exit plan.

Monitor Your Investments: Keep track of how your investments are performing and make adjustments if necessary.

“Looking at your investments as a positive or negative return is not a good way to measure performance. There isn’t an investment out there that only goes up in value with no negative fluctuations from time to time.” – Chris explains.

Rebalancing a portfolio on a regular basis is an important part of maintaining a healthy mix of investments. To help investors make informed decisions, there are a variety of tools and resources available including online brokerage platforms, investment newsletters, investment forums, investment websites, and professional investment advisors. With access to these resources, investors can stay up to date with the latest developments in the markets, identify potential problems or opportunities, and adjust their portfolio to minimize risk and maximize returns.

Have an Exit Plan: An exit plan is a plan for when you will exit an investment. It is essential to have an exit plan in order to maximize profits and minimize losses. Your plan should include your objectives, strategies, and tactics. These objectives should include when to sell, how much to sell, and what price to sell at. Strategies should include diversification, market analysis, and risk management, as we’ve covered, above. Tactics include things like stop-loss orders, trailing stops, and profit-taking. Having an exit plan will help you to make informed decisions about when to exit an investment and maximize your profits.

Let’s explore how Abundance Asset Management is designed to help you invest confidently and safely, regardless of market conditions.

How Abundance Asset Management Restores Investor Confidence

The contrast between FTX and Abundance Asset Management is stunning.

FTX was an unregulated exchange with poor accounting practices and misappropriations of investor funds.

In contrast, Abundance Asset Management is a 506C fund, which falls under regulation D of the securities act. We are fully compliant with all SEC regulations, and we have a registered investment advisor firm and NAV consulting as our third party administrator which helps clients manage risk and implement controls to ensure that investments are secure.

It is like the difference between night and day!

Having a third party administrator provides our investors with the assurance that their investments are being managed in line with the latest regulations and that they have access to up-to-date information regarding their investments. The third party helps to ensure that investments are secure and that the best possible performance is being achieved, and it provides investors with the necessary performance measurement, analysis, support and advice, to make informed decisions and make the most of their investments.

A third party administrator provides this support and guidance to ensure that your investments are secure, up-to-date, and performing optimally.

ONE VERY IMPORTANT LESSON IN INVESTING:

Investing in public equities can be a great way to diversify your portfolio and maximize returns as long as you have access to the right information and support.

It is possible to succeed in different investments and a transition to public equities can be a great opportunity once you learn that you do not need to buy a stock or wait for it to increase in price in order to make a profit.

There are *other strategies* available to you that can help you make money even when the market goes down or sideways. This is especially important for investors who don’t want to take on too much risk.

We use a powerful options strategy, the Abundance Strategy, which is designed to help investors make money in down markets and even benefit from them. We also have partnerships with a tax firm to help with advanced tax strategies and do not use any leverage for trading.

At Abundance Asset Management, we help investors feel confident in their decision to invest with us by providing them with the education, performance, communication, transparency, compliance, and benefits that come along with investing with us.

To encourage confident investment in Abundance Asset Management, we focus on the following areas:

Focus Areas

1. Education. We provide detailed educational resources to investors, such as webinars, tutorials, and question-and-answer sessions on our strategy, the markets and our team so that investors understand exactly how we are operating and why our strategy is beneficial.

2. Performance. We continue to demonstrate positive cash flow and provide investors with proof of our success.

3. Communication. We ensure that we have open and clear communication with our investors, so that they always feel informed and supported.

4. Transparency. We are fully transparent with our strategy, track record, and team, which are clearly outlined and fully available for investors to review so investors can make informed decisions.

5. Compliance. We remain compliant with all SEC regulations and ensure that our investors know that we take their security and privacy seriously.

6. Benefits. We highlight the unique benefits of investing with Abundance Asset Management, such as diversification, cash flow, and better performance than purchasing shares of stock.

Our philanthropic mission

At Abundance Asset Management, our philanthropic mission is to empower individuals and families to build wealth through education and access to our strategies. We believe that financial literacy and access to capital are the foundation for a prosperous future. We strive to provide resources and mentorship to those in underserved communities, to ensure that everyone has the opportunity to reach their financial goals. We also strive to promote responsible investing, as we believe that all investors should be able to make educated decisions and have access to the same information. To further this mission, we offer educational resources and seminars on our strategies and the stock market, and we are committed to fostering the growth of the investing community.

In conclusion, the failure of FTX serves as a reminder of the importance of investing with companies that comply with financial regulations and follow widely-accepted best practices in management, financial accounting, and conducting due diligence. Abundance Asset Management provides a secure and reliable investment platform for investors to build their wealth with confidence. We provide the education, performance, communication, transparency, compliance, and benefits that come along with investing with us. If you’d like to book a no obligation call, we would be more than happy to meet you and discuss your financial goals. Please click here to find a time that works for you https://abundanceassetmanagement.com/calendar.